Please click Terms and conditions to read the Terms of Use of this website before proceeding. Please click the "Accept" button below to continue if you have read and agree to abide by the Terms of Use. Otherwise, please click "Decline" to leave the website.

Terms of Use

You must read the following information before proceeding. By accessing this website / application and any pages thereof, you acknowledge that you have read the following information and accept the terms and conditions set out below and agree to be bound by such terms and conditions. If you do not agree to such terms and conditions, please do not access this website / application or any pages thereof.

General

This website / application has been prepared by FIL Investment Management (Hong Kong) Limited and for informational purposes only. FIL Investment Management (Hong Kong) Limited, FIL Limited and its subsidiaries are commonly referred to as Fidelity or Fidelity International ("Fidelity"). The information on this website / application is intended for Hong Kong residents and is for reference only. None of the Fidelity products referred to on this website have been approved for sale or purchase by any authority outside Hong Kong. Persons resident in territories other than Hong Kong should consult their professional advisers as to whether they may subscribe for the products and services described in this website / application or whether they require any governmental or other consents or need to observe any formalities to enable them to do so. Certain Fidelity products sold in Asia may be established in Luxembourg. The information contained in this website / application does not constitute a distribution, an offer to buy or sell any securities or the solicitation of any offer to buy or sell any securities, engage the investment management services of Fidelity in any jurisdiction in which the distribution or offer is not authorized or would be contrary to local laws or regulations. Without limitation, the information in this website / application is not for distribution and does not constitute an offer to buy or sell any securities in the United States of America to or for the benefit of United States persons (being residents or citizens of the United States of America or partnerships or corporations organized under the laws of the United States of America). It is the responsibility of the persons who access this website / application to observe all applicable laws and regulations.

Fidelity reserves the right to grant or revoke the authority to use the Fidelity Internet sites at its absolute discretion. Whilst every reasonable precaution has been taken to ensure the accuracy, completeness, security and confidentiality of information available through the Fidelity Internet sites, Fidelity makes no warranty as to the accuracy, completeness, security and confidentiality of such information. Fidelity, its affiliates, directors, officers or employees accept no liability for any errors or omissions relating to information available through the Fidelity Internet sites. Fidelity cannot be held responsible for any consequence of any action carried out by any user authorised or unauthorised.

These Terms of Use are in addition to any other agreements between you and FIL Investment Management (Hong Kong) Limited, including any customer or account agreements, and any other agreements that govern your use of FIL Investment Management (Hong Kong) Limited’s products, services, content, tools and information available on this website / application.

We reserve the right to change the website / application and the Terms of Use at any time without notice. If you use the website / application after the amended Terms of Use have been published, you will be deemed to have agreed to the Terms of Use, as amended.

Use of website

Unless otherwise specified, information contained in this website / application does not constitute investment advice or recommendations. Users are solely responsible for determining whether any investment, security or strategy, or any other product or service is appropriate or suitable for them based on their investment objectives and personal and financial situation unless otherwise agreed by FIL Investment Management (Hong Kong) Limited. Any person considering an investment should seek independent advice on the suitability or otherwise of the particular investment. While certain tools available on the website / application may provide general investment or financial analyses based upon your personalized input, such results are for your information purposes only and you should refer to the assumptions and limitations relevant to the use of such tools as set out in this website / application. Users should consult their independent professional advisers should they have any questions. The information contained in this website / application is only accurate on the date such information is published on this website / application.

Third Party Content

This website / application includes material from third parties or links to websites maintained by third parties some of which is supplied by companies that are not affiliated with any Fidelity entity ("Third Party Content"). Third Party Content is available through framed areas, through hyperlinks to third party web sites, or is simply published on the site. The Third Party Content is protected by copyright pursuant to Hong Kong laws and international treaties and is owned or licensed by the Third Party Content provider(s) credited.

Fidelity has not been involved in the preparation, adoption or editing of such third party materials and does not explicitly or implicitly endorse or approve such content. Any opinions or recommendations expressed on third party materials are solely those of the independent providers, not of Fidelity.Fidelity is not responsible for any errors or omissions relating to specific information provided by any third party.

While Fidelity makes every attempt to provide accurate and timely information to serve the needs of users, neither Fidelity nor the Third Party Content providers guarantee its accuracy, timeliness, completeness, usefulness or any other aspect of the information and are not responsible or liable for any such content, including any advertising, products, or other materials on or available from third party sites. You will access and use Third Party Content at your own risk. Third Party Content is provided for informational purposes only, and Fidelity and the Third Party Content providers shall not be liable for any loss or damage arising from your reliance upon such information.

Internet Communication

Messages sent over the Internet cannot be guaranteed to be completely secure. Fidelity will not be responsible for any damages incurred by investors as a result of any delay, loss, diversion, alteration or corruption of any message either sent to or received from Fidelity at investors’ request, over the Internet. Fidelity is not responsible in any manner for direct, indirect, special or consequential damages arising out of the use of this website / application.Communication over the Internet may be subject to interruption, transmission blackout, delayed transmission due to Internet traffic or incorrect data transmission due to the public nature of the Internet or otherwise.

Fidelity does not represent or warrant that this website / application will be available and meet investors requirements, that access will not be interrupted, that there will be no delays, failures, errors or omissions or loss of transmitted information, that no viruses or other contaminating or destructive properties will be transmitted or that no damage will occur to investors computer system. Investors have sole responsibility for adequate protection and back up of data and/or equipment and for undertaking reasonable and appropriate precautions to scan for computer viruses or other destructive properties. Fidelity makes no representations or warranties regarding the accuracy, functionality or performance of any third party software or service providers that may be used in connection with the site.

Intellectual Property Rights

Copyright, trade marks, database rights, patents and all similar rights in this site and the information contained in it are owned by Fidelity, its licensors or relevant third party content providers. Users may use the information on this site and reproduce it in hardcopy for their personal reference only. The information may not otherwise be reproduced, distributed or transmitted to any other person or incorporated in any way in to another database, document or other material. Any copy of materials which a user makes from the site must retain all copyright or other proprietary notices and disclaimers contained therein. Trade names referred to in this site are trade marks owned by or licensed to Fidelity or other content providers. Trade marks owned by Fidelity or providers of content on the site are used to act as an indication of source or origin of associated services. Nothing on this site should be considered as granting any licence or right under any trade mark of Fidelity or any third party, nor should a user attempt to use, copy adapt or attempt to register any similar trade marks to any trade marks or logos appearing on the website / application or in the Information herein.

Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited.

Third party marks appearing in this website / application are the property of their respective owners and used with the permission of such owners, where necessary.

Governing Law

These Terms of Use shall be governed by the laws of Hong Kong Special Administrative Region.

Languages

In case of discrepancies between the English and Chinese language versions of these Terms of Use and content of this website / application, the English version shall prevail.

How high quality dividends could boost income generation

In a financial landscape marked by economic challenges, geopolitical uncertainty, and policy speculation, we believe a high quality dividend strategy investing in defensive stocks could provide income seekers with valuable portfolio diversification.

- The financial backdrop remains challenging for investors.

- However, market participants are looking beyond the headlines and identifying positive signals.

- In such an environment, active managers seek to identify robust businesses that can steadily deliver healthy dividend payouts.

- Company fundamentals remain key regardless of the macroeconomic picture.

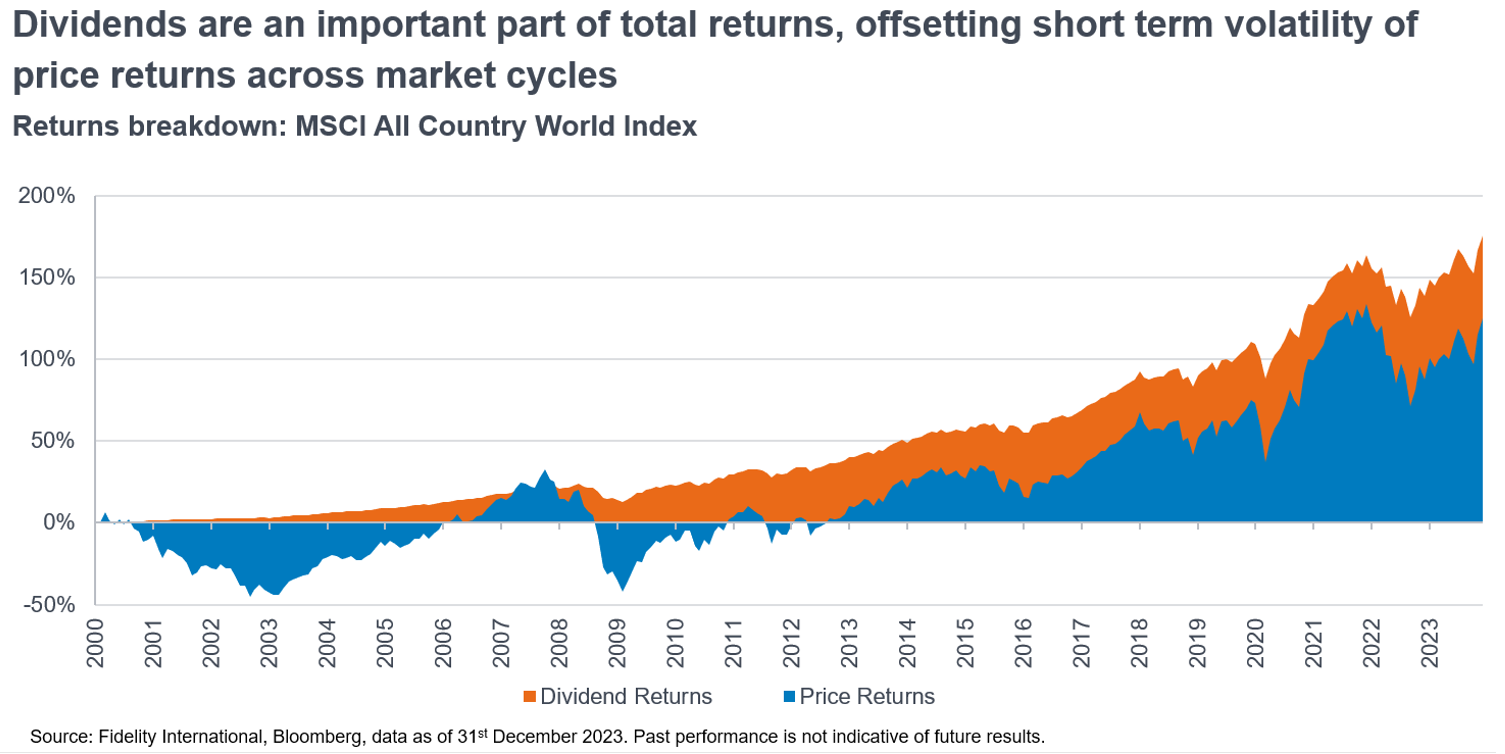

- Dividends have historically constituted a sizeable portion of stock returns and outpaced inflation.

- In tandem with solid dividends, our managers aim to enhance client income with targeted portfolio strategies, such as covered calls.

- Areas of interest currently include defensive names given their attractive valuation frameworks, non-bank institutions such as insurance firms, and Asia with its growing number of industry leaders, especially in the semiconductor space.

Financial markets currently face a combination of diverse signals that have shaped the actions of policymakers and central banks. For instance, core and services inflation remains a challenge. At the same time, unemployment in the US is rising while job creation has slowed. Into this mix, we also have diminished excess savings and a rise in consumer credit defaults. Elsewhere, geopolitical tension in the Middle East persists.

Yet despite these roadblocks, stock market valuations are improving as investors look through these challenges. Inflation, although sticky, has fallen significantly year-on-year. The US unemployment rate remains at a 50-year low, the credit-to-income ratio has declined, and people's financial health is still reasonably robust.

We have also started to see interest rate cuts, and the most recent quarterly earnings numbers show that many companies are in good shape. Meanwhile, concerns about the profit sustainability of US tech giants have seen investors broaden their horizons and embrace value names and businesses with a smaller market capitalisation.

Against this backdrop and given the difficulties investors face in predicting the economic outlook, an active approach to assessing the market from a bottom-up perspective and identifying defensive companies that will perform well in good times and bad could make a difference.

As always, the long-term driving force of the stock market remains corporate fundamentals, and in an often-complex trading environment, we believe that a dividend-focused strategy could attract investors who may feel buffeted by persistent uncertainty.

Actively managed income enhancement

Dividends are a significant contributor to the total return of the stock market. Indeed, statistics show that over 30 per cent of the cumulative rate of return on equities in the US has been driven by dividend payments. What’s more, US dividends have historically offered a robust inflation hedge1. Dividend yields tend to be more resilient to market volatility too.

By adopting an active management approach, we have demonstrated that our dividend strategies can generate more diverse and higher-quality income options. We can also strengthen dividend income by reducing a portfolio’s dependence on economically sensitive industries and focusing on sustainability leaders. Therefore, we look at well-managed, high quality firms with transparent business models and healthy balance sheets that can consistently deliver solid returns irrespective of the economic cycle.

Returns can also be enhanced with the use of portfolio management strategies like covered calls, which we feel is an attractive, suitable and sustainable method of generating a potentially elevated income level.

Emerging investment opportunities

For instance, we have recently seen investment opportunities in defensive names, given their valuation frameworks now appear more attractive following a period when they lagged growth-oriented technology or internet-related companies.

While in the financials segment, there are interesting ideas among non-bank institutions, including insurance firms that are less immune to changes in borrowing costs than banks. However, among the banks we are watching, our focus is on companies that have improved shareholder returns due to a strengthening of their capital positions.

Regionally, Asia boasts a growing number of industry leaders, especially in the semiconductor space, so we also see potential to harness these developments.

1 https://www.spglobal.com/spdji/en/research/article/a-fundamental-look-at-sp-500-dividend-aristocrats/